Programmatic advertising is in a strange state.

User engagement is high as ever with higher consumption of media, yet at the same time, demand from advertisers has been record-low, explains Andrew Casale at AdAge.

Budgets have been cut and ad categories paused. In April, we saw this result in an overall drop in programmatic spend, but now as the economy reopens, that initial slump has rebounded.

Who is driving the growth? Here we share our insights.

We encourage you to subscribe to our blog for the latest data surrounding the advertising industry. We will provide daily updates as COVID-19 continues to make its mark on the US economy.

State of Programmatic in May

The trend of consolidation in ad tech continues to unfold. One of the biggest industry players may be up for sale soon.

The leading demand-side platform (DSP) MediaMath is now “exploring its strategic options.”

Over the last few years, the platform hasn’t been able to keep up with The Trade Desk, a quickly growing DSP competitor. In April, the company laid off 8% of its team and cut pay and benefits among those who stayed on.

The consolidation of the major platform reflects the dichotomous state of the market. Ad tech companies are joining forces for survival, while the majority of marketers plan to increase their programmatic budgets.

A recent survey from Ascend2 shows that 66% of marketers expect to increase their programmatic spend in the upcoming months. This stems from a desire to stretch their dollars further during a recession. Programmatic ads are perceived to drive results from a better use of targeted ads.

Even though programmatic ads have their own challenges, marketers view the flexibility, automation and reporting more valuable in a time of recession than the services of direct publishers.

But ad tech companies will have to expect picky buyers.

“While many tools or companies may say they deliver value, it’s important to partner with those you can trust to deliver results, especially in these uncertain times,” says Co-Founder at TRADR.tv Ben Zimmerman. Advertisers have been calling for greater transparency in programmatic for years — but this recession might be the final push for higher expectations.

DSPs and SSPs will have to prove their value to their customers in a time marked by steep competition.

MediaRadar Insights

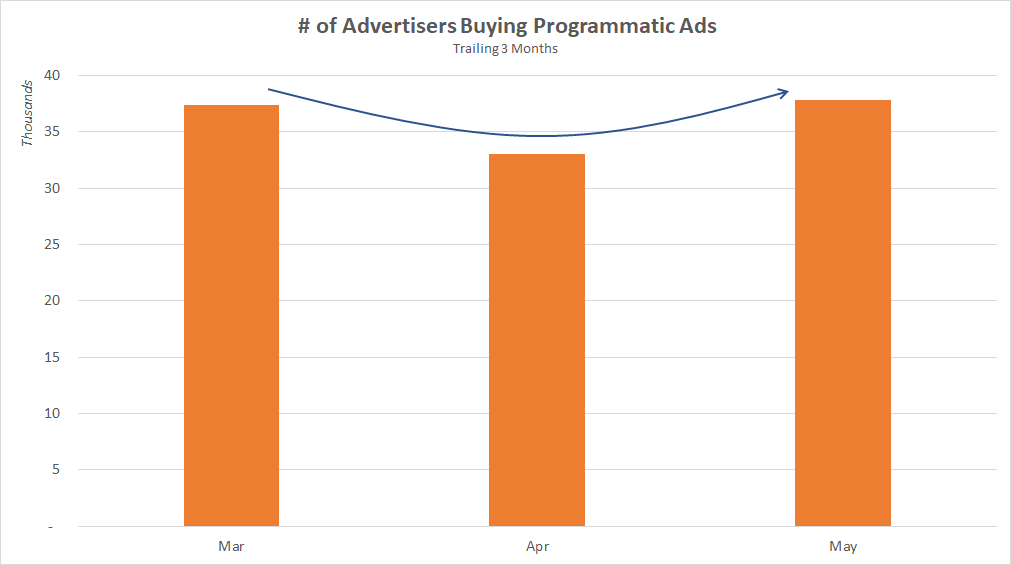

It was not a surprise when we saw a slump in the number of advertisers buying programmatic ads in April. The good news is that those numbers already rose back to normal levels in May.

Many major slices of the market increased programmatic spending MoM. They include:

- Streaming Services: +53%

- Property for Sale: +153%

- Cellular Provider +18%

- Auto Dealership +7%

- Sportswear: +31%

Brands increasing spend on programmatic in May include:

- Spectrum

- LendingTree

- StateFarm Car Insurance

- Salesforce

- Verizon Wireless

Collectively, these brands spent almost $30M on programmatic ads in May. We are only halfway through June — these numbers may increase if marketers stay true to their predicted increased budgets. Advertisers want to get the most targeted ads out in times of uncertainty. With that, we will be watching who is spending the most and prioritizing this form of buying.

For more updates like this, stay tuned. Subscribe to our blog for more updates on coronavirus and its mark on the economy.